FAIR ISAAC (FICO)·Q1 2026 Earnings Summary

FICO Beats Q1 Estimates But Guidance Misses Consensus — Stock Falls 2.5%

January 28, 2026 · by Fintool AI Agent

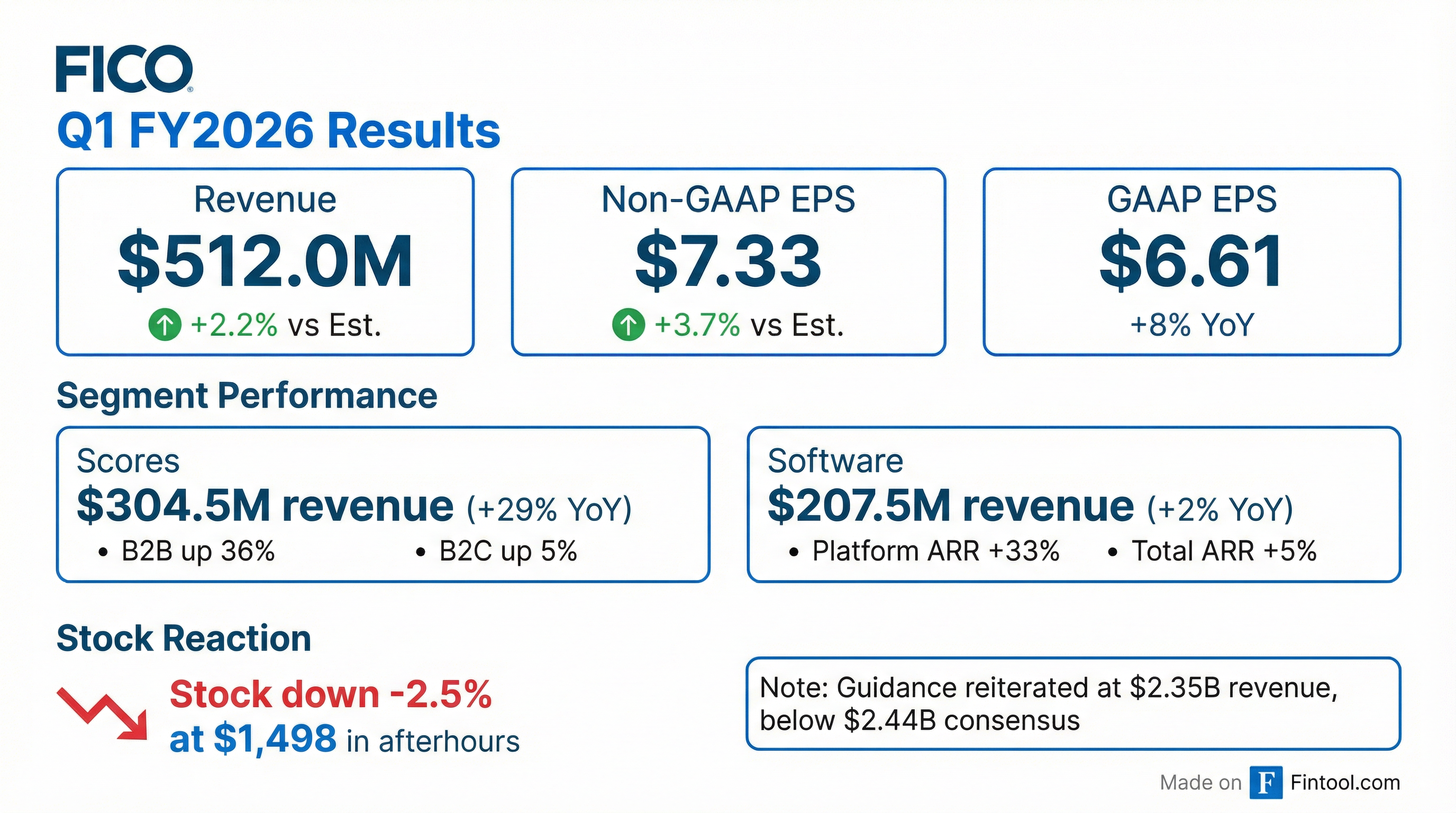

Fair Isaac Corporation (FICO) delivered a solid Q1 FY2026, beating both revenue and earnings estimates, but shares fell 2.5% in after-hours trading as the company's reiterated full-year guidance came in below Street expectations. The quarter was powered by Scores segment strength, with B2B revenue surging 36% on mortgage pricing tailwinds.

Did FICO Beat Earnings?

Yes — FICO beat on both metrics:

Revenue grew 16% year-over-year from $440M in Q1 FY2025, while Non-GAAP EPS climbed 27% from $5.79.

This marks FICO's third consecutive quarterly beat following strong Q3 (+19%) and Q4 (+13%) FY2025 EPS surprises.

What Drove the Beat?

Scores Segment: +29% YoY

The Scores business delivered $304.5M in revenue, up from $235.7M in the prior year:

Detailed B2B breakout from the call:

The B2B outperformance was driven by mortgage tailwinds — FICO has been raising prices on mortgage origination scores, and volume has increased as rates stabilized. Mortgage originations now account for 42% of total Scores revenue.

Software Segment: +2% YoY

Software revenue was $207.5M vs $204.3M prior year — a modest 2% increase masking a tale of two platforms:

The Platform transition is working — customers are migrating to FICO's modern cloud-based decisioning platform, with 122% net retention showing expansion within accounts. FICO now has over 150 customers on FICO Platform, with more than half leveraging it for multiple use cases.

Software ACV bookings hit a record $38M in Q1, including an above-average-sized international multi-use case platform deal. Trailing twelve-month ACV bookings reached $119M, up 36% YoY.

Total software ARR stands at $766M (+5% YoY), with Platform ARR at $303M representing 40% of total. Excluding a liquid credit migration, platform ARR growth was in the high 20% range.

Strategic Initiatives: What's New?

UltraFICO Partnership with Plaid

FICO announced a strategic partnership with Plaid to deliver a next-generation UltraFICO Score. The enhanced score combines FICO's credit scoring with real-time cash flow data from Plaid's open finance network, providing lenders with a single enhanced credit score for superior risk assessment.

"Plaid powers nearly 1 million secure financial connections each day and has helped more than half of Americans with a bank account securely move more of their financial life online." — Will Lansing

The solution is credit bureau agnostic and expected to launch in the first half of calendar 2026.

FICO Score Mortgage Simulator Adoption

5 resellers have adopted the FICO Score Mortgage Simulator (Xactus, MeridianLink, SharperLending, Credit Interlink, Ascend Partners), with another large reseller expected to sign shortly. The simulator helps mortgage professionals run credit event scenarios to improve borrower outcomes.

Gartner Recognition

FICO was recognized as a Leader in the January 2026 Gartner Magic Quadrant for Decision Intelligence Platforms, positioned highest for ability to execute.

FICO Score 10T Adopter Program

The company has nearly doubled the number of lenders in its FICO Score 10T adopter program over the last year. These lenders account for more than $377 billion in annual originations and $1.6 trillion in eligible servicing volume, with most making multiyear commitments.

What Did Management Guide?

FICO reiterated full-year FY2026 guidance — the problem is it's below consensus:

CEO Will Lansing noted: "We had a good start to our fiscal year, with strong top and bottom-line growth. We reiterate our fiscal year 2026 guidance, which yields stronger growth than we achieved in FY25."

The issue: after beating Q1 and with Scores firing on all cylinders, investors expected a guidance raise. Reiterating guidance after a strong quarter sends a cautious signal about the sustainability of mortgage-driven Scores growth.

How Did the Stock React?

Down 2.5% in after-hours despite the beat:

The stock has pulled back 31% from its 52-week high, reflecting multiple compression amid growth deceleration concerns. Today's guidance reiteration (vs. a raise) added to selling pressure.

What Changed From Last Quarter?

Key margin callout: Non-GAAP operating margin expanded 432 basis points year-over-year to 54%, reflecting strong Scores segment leverage.

Key changes:

- Scores acceleration: B2B growth jumped to +36% with mortgage originations up 60% on pricing

- Margin expansion: Non-GAAP operating margin expanded 432 bps YoY to 54%

- Capital allocation: Repurchased 95,000 shares at average price of $1,707 for $163M

- Balance sheet: $218M cash, $3.2B total debt at 5.22% weighted average rate

Earnings Beat Streak

FICO has now beaten EPS estimates in 3 of the last 4 quarters:

The Q1 FY25 miss last year coincided with mortgage market weakness. This quarter's beat reflects mortgage recovery — but the lack of guidance raise suggests management isn't confident the tailwind persists.

Q&A Highlights: What Analysts Asked

Direct License Program Progress

Management confirmed 5 resellers have signed for the FICO Mortgage Direct Licensing Program (Xactus, Cotality, Ascend Companies, CIC Credit, MeridianLink), representing approximately 70-80% of the total reseller market.

"One large reseller is close to completing production integration testing. Another large reseller has completed that testing and is now testing system integration downstream." — Will Lansing, CEO

The Direct License Program is on track, though management would not commit to a specific go-live timeline. Resellers are expected to go live in a "staggered but close in time" manner, not simultaneously.

FICO Score 10T Timeline

The GSEs are still testing FICO Score 10T and haven't published a timeline for general availability. Management noted the industry prefers simultaneous release of 10T and VantageScore LLPA grids.

"Our research suggests that the FICO score and the Vantage score are more than 20 points different, 30% of the time, in both directions... it's very, very hard to just substitute one score for another." — Will Lansing

Why No Guidance Raise?

Despite the strong Q1, management declined to raise guidance, citing macro uncertainty:

"There's just a lot of questions out in the macro environment. With the Fed today... we don't probably know what numbers we would move to. By next quarter, we'll have a much better idea of what the world looks like." — Steve Weber, CFO

Credit Card APR Cap Impact

Asked about President Trump's proposed 10% credit card interest rate cap, management said they haven't seen any changes in lender behavior yet. If implemented, subprime lending could shift to other products (personal loans, BNPL), where FICO scores would still be used.

Platform Investment Cycle

Management indicated they remain in investment mode for the software platform, but expect margin expansion from scaling: "The improvements to profitability of our software business will come more from additional volume and additional customers on the new platform versus reduced R&D spending."

Key Risks and Watch Items

-

Mortgage rate sensitivity: Scores B2B growth is heavily tied to mortgage origination volumes. If rates rise again or volumes decline, this 36% growth rate is unsustainable.

-

Non-platform software attrition: The -8% ARR decline in legacy software is a headwind that platform growth must overcome.

-

Valuation premium at risk: FICO trades at ~36x forward earnings. Guidance below consensus challenges the premium multiple.

-

Cash flow deceleration: Free cash flow declined 11% YoY in Q1. Working capital timing or structural change?

Geographic Revenue Mix

From the call, FICO's revenue remains heavily U.S.-centric:

Bottom Line

FICO delivered a clean beat on revenue (+2.2%) and EPS (+3.7%), driven by Scores segment strength with mortgage originations up 60% YoY. The Direct License Program gained momentum with 5 resellers signed representing 70-80% of the market, and the software platform continues to show healthy 122% net retention with 150+ customers.

However, the company reiterated rather than raised full-year guidance despite the beat, with management citing macro uncertainty as the reason. FY2026 guidance of $2.35B revenue and $38.17 Non-GAAP EPS trails Street estimates by 4-6%. This "beat and don't raise" dynamic sent shares down 2.5% after hours.

The key debates:

- Is mortgage growth sustainable? Scores B2B growth of 36% depends on mortgage volumes and pricing

- When does the Direct License Program go live? Testing is advanced but no timeline committed

- Will the platform transition accelerate? ACV bookings hit a record, but non-platform ARR continues declining

Report generated by Fintool AI Agent on January 28, 2026. Data sources: FICO Q1 FY2026 earnings call transcript, 8-K filing, S&P Global estimates, market data.